Are you looking for a customs broker who knows the ways of foreign trade to perfection? In Partida Logistics we manage the customs procedures of your goods, advising you based on the current regulations, your casuistry, type of product, origin/destination and agreed Incoterm; in order to make your customs declarations properly and be part of your commercial success.

Centralized Customs Clearance

An import is based on the purchase of products or goods from a country located outside the customs territory of the European Union to a country located within the European Union.

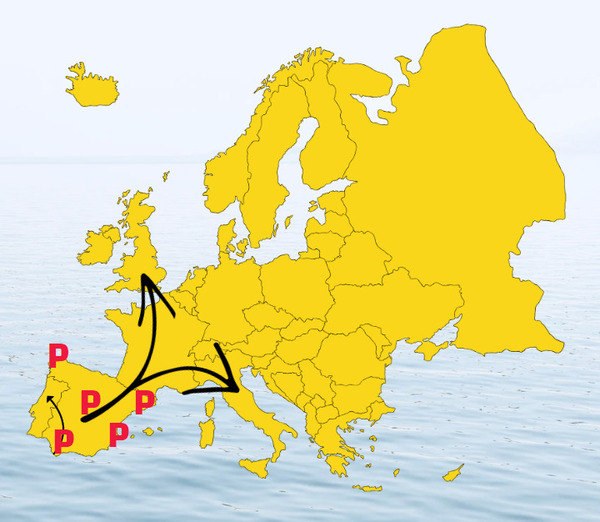

Through the ports and customs points of Spain, from Partida Logistics, as an import customs clearance, we have the possibility to manage these imports whose final destination is Spain; as well as any other European country.

Before acquiring goods from a third country, it is important to know the import and marketing regulations in force in the place where the products are to be sold, marketed or consumed.

In this way, we will avoid possible mishaps and sanctions by the competent authorities.

Centralized Customs Clearance

Thanks to the certificate of Authorized Economic Operator, granted by customs, we have the ability to clear goods to meet the needs of all our customers located in various areas of the Spanish territory.

In this way, we can provide logistic alternatives, both maritime and terrestrial, to make the cost of the operation viable and lower.

Import clearance + Fiscal Representation

The fiscal representative is the natural or legal person who has the power to represent any company not incorporated for tax purposes in Spain before Customs.

The Customs Representative processes the customs import clearance for free circulation on behalf of the European company, as long as the merchandise has as final destination any country of the European Union, except Spain.

It acts as an interlocutor with the Spanish and European authorities to ensure that goods entering through Spanish ports leave the country, as well as to inform the destination customs office about the import activities of such a company.

This is the only way to ensure that the VAT corresponding to each European country will be paid.

The company is required to pay the corresponding VAT in the corresponding European country.

PARTIDA has been doing this for some time.

The great benefit that we provide to these companies, to which we clear goods for customs purposes in Spain, is that we do not require any additional processing or action within the European territory when the goods arrive at their destinations or unloading warehouses.

A team prepared to manage large volumes

Export Dispatch

An export clearance is in charge of the set of formalities and controls that goods must go through to make the correct sale to a country located outside the customs territory of the European Union; as well as to Switzerland, Norway, Iceland and Liechtenstein (EFTA).

Before exporting goods from Spain or from any European country, it is important to know the import and marketing regulations of the place where the products are going to be sold, marketed or consumed.

In this way, we will avoid mishaps or possible sanctions imposed by the authorities.

Brexit

Much has already happened since the United Kingdom’s exit from the European Union.

Supply chains have adjusted their casuistry and adapted to the new customs and logistics reality.

Given its historical position among the top five destination countries for Spanish goods exports, the United Kingdom is and will continue to be considered a strategic market for Spain.

PARTIDA’s Brexit team will advise you on customs and logistics so that you only continue to worry about selling more and better to the UK.

We take care of coordinating your logistics chain with the carrier and importer.

Frequently Asked Questions

On certain occasions, dealing with all the existing customs regulations can be a tedious and risky process. A customs broker, precisely, is a figure that is responsible for acting as an intermediary between companies and the authorities in order to carry out both the import and export of goods in a professional and safe manner. Its purpose is mainly to facilitate and expedite this cumbersome process, complying at all times with the existing regulations in force.

Once we know the existence of the term, what are the main functions of a customs clearance office?

- Advice on customs matters (permits, licenses, Incoterms, types of sales, taxation, accounting, EORI code processing and registration with the various agencies).

- Logistics orientation (Incoterms, sea and land transportation, warehousing and quality controls)

- Study of the correct tariff heading to find out the % of VAT and tariffs to be paid at destination, if any.

- Preparation and presentation in the appropriate format of the necessary documentation for the correct import and export of the goods: commercial invoice, packing list, bill of landing, EUR-1, certificate of origin, phytosanitary certificate, declaration of additives and declaration of plastics, among others.

- Guide for requesting deferred VAT for importing companies.

- Customs procedures for warehouses (LAME, ADT, DA).

- Processing of AEO and Compliance Certificates.

- Legal advice throughout the process to comply with current regulations.

- Support in the processing of tax establishment of non-resident companies in Spain.

Partida Logistics provides our clients with all these customs services with the objective of guaranteeing not only the correct import and export of their merchandise, but also the adequate representation and optimal advice during the whole process.

Do you want to make sure that your customs procedures are carried out properly? Are you looking to reduce the risks that may arise from possible errors and penalties? Do you want to enjoy the peace of mind and confidence of knowing that your operations are carried out correctly? At Partida Logistics we have more than 100 years of experience as Customs Representatives!

We provide a comprehensive service through the ports of Algeciras, Motril, Almeria and Tangier for all goods transported by container and truck.

If you need more information, please contact us. We are a team of qualified professionals who are constantly updated on customs regulations and will provide you with personalized attention that will meet your needs at all times.

It is the figure specialized in customs matters, which is responsible for carrying out the corresponding customs procedures on behalf of the company or individual who wishes to import and/or export goods with countries outside the European Union.

In charge of:

- Advise on foreign trade

- Verify the purchase and sale documentation (commercial invoice, packing list, Bill of Landing, certificates of origin, EUR-1, phytosanitary certificates…).

- Correctly classify the tariff heading of the merchandise.

- Submit documents and petitions to Customs.

- Payment of taxes and/or duties, if any

- Be present during physical inspections of the goods

- Report on Customs notifications.

- Coordinating the supply chain with other logistics providers

They are professionals with the title of Customs Representative with the capacity to process customs clearances in import, export and transit regimes (T-1, T2, T2L) of any type of merchandise.

- Have an EORI code

- Be registered in the Exporter Registration System (REX).

- Properly issue the following documents:

- Commercial invoice

- Packing List

- Agreeing an Incoterm with the importer

- Establish the type of sale (firm or consignment)

- Manage your accounting and VAT taxation correctly.

Regardless of where you are located in Spain (or Portugal) PARTIDA has the capacity to clear and process certificates (Soivre, Health, Fito, Veterinary…) at any customs point in Spain.

Our team operates in morning, afternoon and night shifts 365 days a year.

In addition to processing exports to the UK, this department also handles export shipments to Switzerland, Norway, Iceland and Liechtenstein.

- Confirm that it has a tax identification number, EORI code and that it is registered with the pertinent organizations according to the type of merchandise (perishable, frozen, industrial, electronics, clothing, dangerous goods, live animals, etc.).

- Review with PARTIDA the certificates and documents issued at origin (commercial invoice, packing list, CMR/bill of landing, EUR-1, declaration of plastics, additives…).

- Find out the % of VAT and tariffs to be paid, if any

- Agree on an Incoterm with the seller/supplier/exporter at origin.

- Examine the correct tariff item (HS CODE)

- Study which type of import clearance is appropriate in line with the operation (temporary, inward or outward processing).

- Coordinate the logistics chain with carriers and/or shipping companies.

Our customers endorse us

Testimonials from customers who have placed their trust in us

I am very satisfied with the Key Account Manager service offered by PARTIDA.

If I think of companies that provide similar services, PARTIDA is the best option.

Excellent service, they are the best option without a doubt. I would recommend them 100%.

A 5 star service

Customs news

In this section you will be updated on the latest news of the sector